Hsmb Advisory Llc Fundamentals Explained

Table of Contents5 Simple Techniques For Hsmb Advisory LlcThe Buzz on Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingExamine This Report about Hsmb Advisory LlcExamine This Report on Hsmb Advisory LlcNot known Incorrect Statements About Hsmb Advisory Llc

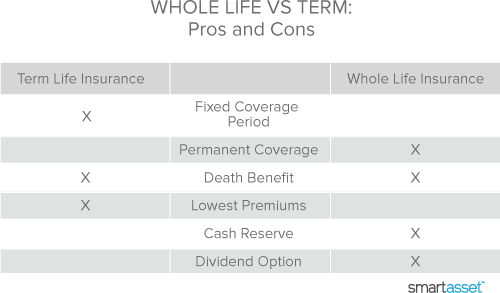

Ford claims to avoid "cash money value or permanent" life insurance, which is more of an investment than an insurance coverage. "Those are really complicated, featured high commissions, and 9 out of 10 people don't require them. They're oversold due to the fact that insurance agents make the biggest commissions on these," he states.

Disability insurance can be pricey, nevertheless. And for those who choose for long-term care insurance policy, this policy might make special needs insurance unneeded. Find out more regarding lasting care insurance coverage and whether it's best for you in the following area. Long-term treatment insurance can assist pay for costs linked with long-lasting treatment as we age.

The Single Strategy To Use For Hsmb Advisory Llc

If you have a persistent health and wellness problem, this sort of insurance coverage might end up being important (St Petersburg, FL Life Insurance). Do not allow it emphasize you or your financial institution account early in lifeit's generally best to take out a plan in your 50s or 60s with the expectancy that you won't be utilizing it till your 70s or later.

If you're a small-business owner, consider protecting your resources by buying service insurance. In the event of a disaster-related closure or duration of restoring, service insurance can cover your revenue loss. Consider if a substantial weather occasion influenced your store front or production facilityhow would certainly that impact your income? And for for how long? According to a record by FEMA, in between 4060% of little services never reopen their doors following a calamity.

Plus, making use of insurance could sometimes cost more than it conserves in the future. As an example, if you obtain a contribute your windscreen, you may think about covering the repair service expenditure with your emergency situation cost savings as opposed to your car insurance. Why? Since using your car insurance coverage can trigger your month-to-month premium to increase.

Some Ideas on Hsmb Advisory Llc You Need To Know

Share these tips to protect enjoyed ones from being both underinsured and overinsuredand talk to a relied on expert when needed. (https://hsmbadvisory.edublogs.org/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-comprehensive-coverage/)

Insurance that is purchased by a private for single-person insurance coverage or insurance coverage of a household. The individual pays the costs, instead of employer-based health and wellness insurance policy where the employer commonly pays a share of the premium. Individuals may purchase and purchase insurance policy from any kind of plans available in the person's geographical area.

Individuals and families might qualify for financial assistance to decrease the price of insurance coverage costs and out-of-pocket expenses, but just when enrolling via Attach for Wellness Colorado. If you experience particular changes in your life,, you are qualified for a 60-day duration of time where you can enlist in a private strategy, even if it is outside of the yearly open registration duration of Nov.

15.

It may appear easy however comprehending insurance coverage kinds can likewise be perplexing. Much of this confusion originates from the insurance policy sector's ongoing objective to create personalized coverage for insurance policy holders. In designing flexible policies, there are a range to select fromand all of those insurance policy kinds can make it hard to comprehend what a details plan is and does.

5 Easy Facts About Hsmb Advisory Llc Shown

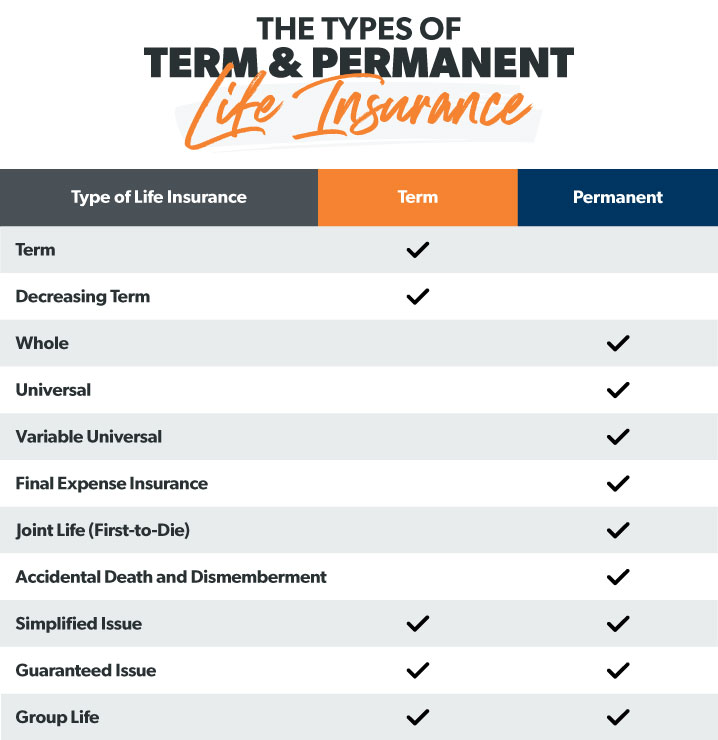

The most effective area to start is to discuss the difference in between the two kinds of standard life insurance policy: term life insurance policy and irreversible life insurance policy. Term life insurance coverage is life insurance policy that is just energetic for a time duration. If you die throughout this duration, the individual or people you've named as beneficiaries may get the cash payout of the policy.

Numerous term life insurance policy plans let you transform them to an entire life insurance policy, so you do not shed insurance coverage. Normally, term life insurance coverage policy premium repayments (what you pay monthly or year right into your plan) are not secured at the time of acquisition, so every 5 or 10 years you own the policy, your costs can climb.

They also have a tendency to be less costly overall than whole life, unless you purchase a whole life insurance policy when you're young. There are additionally a couple of variants on term life insurance. One, called group term life insurance policy, prevails among insurance options you may have accessibility to with your employer.

3 Simple Techniques For Hsmb Advisory Llc

Another variant that you might have accessibility to via your employer is Insurance Advisors additional life insurance policy., or burial insuranceadditional insurance coverage that could assist your family members in instance something unanticipated takes place to you.

Permanent life insurance coverage merely refers to any life insurance plan that does not run out.